Imagine yourself diving into the world of forex trading, where every moment is an opportunity to make profits. In this article, we will explore the essentials of day trading in forex, shedding light on fx trading and foreign exchange. Whether you’re a newbie or an experienced trader looking to brush up on your skills, we’ve got you covered. So, buckle up and get ready to embark on an exciting journey into the basics of day trading in forex.

Understanding Day Trading

Day trading is a trading strategy where you enter and exit trades within the same trading day. It involves buying and selling financial instruments, such as stocks, currencies, or commodities, with the goal of making short-term profits. Unlike other trading strategies that focus on long-term investments, day trading requires active monitoring of the market throughout the day to identify and capitalize on short-term price movements.

What is day trading?

Day trading is a fast-paced trading strategy that aims to profit from the intra-day price fluctuations of financial instruments. Traders who engage in day trading typically take multiple trades in a single day, making quick decisions based on technical or fundamental analysis.

How does day trading in forex work?

Forex, short for foreign exchange, refers to the global decentralized market where currencies are traded. Day trading in forex involves buying and selling currency pairs with the aim of profiting from short-term price movements.

In day trading forex, traders typically focus on major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY. These pairs have high liquidity and are subject to frequent price fluctuations. Traders use technical analysis, fundamental analysis, or a combination of both to identify potential trade setups.

To execute trades, day traders use an online trading platform provided by a forex broker. These platforms offer real-time market data, charting tools, and order placement functionalities. Traders can enter and exit positions instantly, taking advantage of short-term price movements.

Advantages and risks of day trading

Day trading offers several advantages for traders looking for short-term opportunities. One of the main advantages is the potential for quick profits. By taking advantage of intraday price movements, day traders can generate profits in a relatively short amount of time.

Another advantage of day trading is the ability to trade multiple times per day. This allows traders to capitalize on various market conditions and increase their chances of finding profitable trades.

However, day trading also comes with its risks. One of the main risks is the potential for significant losses. Since day traders take multiple trades per day, a losing streak can quickly deplete their account balance. Additionally, the fast-paced nature of day trading can lead to impulsive decisions and emotional trading, which can negatively impact profitability.

To mitigate these risks, day traders need to have a solid understanding of risk management strategies and psychological discipline. It is crucial to set stop-loss and take-profit levels, implement proper position sizing, and use a risk-reward ratio to ensure consistent and controlled trading outcomes.

Setting Up for Day Trading

Before diving into day trading, it is essential to have the necessary tools and knowledge to set yourself up for success.

Choosing a reliable forex broker

One of the crucial steps in day trading forex is choosing a reliable forex broker. A forex broker acts as an intermediary between you and the forex market, providing you with access to trading platforms, market data, and execution services.

When selecting a forex broker, consider factors such as regulation, reputation, trading platform features, spreads, commissions, and customer support. It is important to choose a broker that aligns with your trading needs and offers a reliable and secure trading environment.

Understanding the forex market hours

Unlike other financial markets, the forex market operates 24 hours a day, five days a week. Understanding the forex market hours is vital for day traders, as it determines the most active trading periods and can impact trading strategies.

The forex market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Each session has different characteristics and trading volumes. Day traders should be aware of overlapping sessions, as they tend to have higher liquidity and increased trading opportunities.

Creating a trading plan

A trading plan is a crucial component of successful day trading. It serves as a roadmap that outlines your trading goals, trading strategy, risk management rules, and criteria for entering and exiting trades.

When creating a trading plan, consider factors such as your trading style, time availability, risk tolerance, and financial goals. Your plan should include clear entry and exit criteria, guidelines on trade management, and rules for adjusting or closing trades based on market conditions.

A well-defined trading plan helps to eliminate emotions in decision-making and provides a structured approach to your day trading activities.

Fundamental Analysis in Day Trading

Fundamental analysis is a method of evaluating financial instruments based on economic, political, and social factors that can impact their value. In day trading, fundamental analysis can help traders identify trading opportunities and understand the underlying forces driving price movements.

Introduction to fundamental analysis

Fundamental analysis involves examining macroeconomic indicators, economic news, and geopolitical events to assess the intrinsic value of a financial instrument. Traders look at factors such as interest rates, employment data, GDP growth, inflation, and central bank policies to gauge the strength or weakness of a country’s economy.

By understanding the fundamental factors that influence currency values, day traders can make informed trading decisions and capitalize on economic trends.

Economic indicators to watch

There are several key economic indicators that day traders should monitor when conducting fundamental analysis. Some of the essential indicators include:

-

Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country’s borders. It provides insight into the overall health and growth of an economy.

-

Interest rates: Central banks use interest rates to control inflation and stimulate or slow down economic growth. Changes in interest rates can have a significant impact on currency values.

-

Employment data: Unemployment rates, non-farm payrolls, and jobless claims provide insights into the labor market’s strength and can impact currency values.

-

Consumer Price Index (CPI): CPI measures changes in the average prices of a basket of goods and services. It is used to track inflation levels and can influence central bank decisions.

Monitoring these economic indicators and understanding their potential impact on the forex market can help day traders make well-informed trading decisions.

Analyzing news and events

In addition to economic indicators, day traders should stay updated on market news and events that can impact currency prices. News releases, speeches by central bank officials, geopolitical developments, and natural disasters can all have a significant impact on the forex market.

Traders can stay informed by following financial news outlets, subscribing to economic calendars, and using news aggregation platforms. By understanding the potential impact of news and events, day traders can adjust their trading strategies accordingly and take advantage of market volatility.

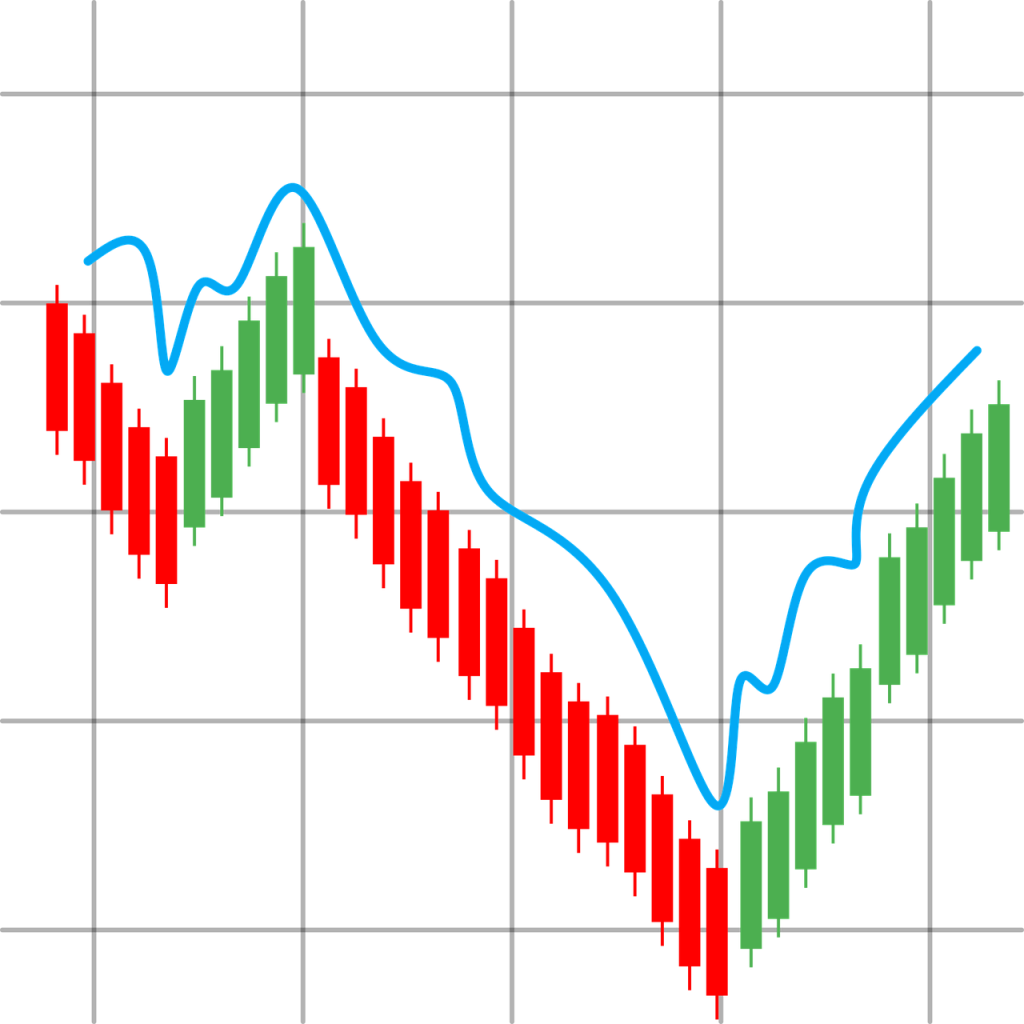

Technical Analysis in Day Trading

Technical analysis involves analyzing historical price and volume data to identify patterns, trends, and potential trading opportunities. In day trading, technical analysis is an essential tool for identifying entry and exit points and making informed trading decisions.

Introduction to technical analysis

Technical analysis is based on the belief that historical price data can provide insights into future price movements. It focuses on analyzing charts, patterns, and indicators to identify trends, support and resistance levels, and potential reversal points.

Traders use various technical analysis tools, such as moving averages, oscillators, and chart patterns, to analyze price data and develop trading strategies. By understanding market trends and patterns, day traders can spot potential entry and exit points and make informed trading decisions.

Key technical indicators

There are numerous technical indicators that day traders can use to analyze price data and identify trading opportunities. Some of the popular technical indicators include:

-

Moving averages: Moving averages smooth out price data and help identify trends. The most commonly used moving averages are the simple moving average (SMA) and the exponential moving average (EMA).

-

Relative Strength Index (RSI): RSI is an oscillator that measures the speed and change of price movements. It helps identify overbought or oversold conditions in the market.

-

Bollinger Bands: Bollinger Bands consist of a moving average and two standard deviations plotted above and below the moving average. They help identify periods of high or low volatility.

These are just a few examples of technical indicators that day traders can use to analyze price data. It is important to experiment with different indicators and find ones that align with your trading strategy and style.

Chart patterns and trend analysis

Chart patterns are visual representations of price movements that can provide insights into market trends and potential trading opportunities. Day traders use chart patterns to identify trends, reversals, and continuation patterns, which can indicate the future direction of price movements.

Some of the commonly used chart patterns in day trading include:

-

Head and Shoulders: This pattern consists of a peak (head) and two lower peaks (shoulders). It indicates a potential reversal from an uptrend to a downtrend.

-

Double Tops and Double Bottoms: These patterns occur when price reaches a resistance level (double top) or a support level (double bottom) twice without breaking through. They can indicate a potential trend reversal.

-

Flags and Pennants: These patterns are continuation patterns that occur after a strong price move. They are characterized by a period of consolidation, followed by a resumption of the previous trend.

By understanding chart patterns and trend analysis, day traders can identify potential entry and exit points and make informed trading decisions.

Risk Management Strategies

Risk management is a critical aspect of day trading that aims to protect capital and minimize losses. Implementing effective risk management strategies is essential to ensure long-term profitability and success.

Setting Stop Loss and Take Profit levels

Stop loss and take profit levels are predetermined price levels at which traders exit a trade to limit losses or lock in profits. Setting appropriate stop loss and take profit levels is crucial to limit potential losses and protect trading capital.

Stop loss levels should be set at a price level that, when reached, would indicate that the trade is no longer valid. Take profit levels, on the other hand, should be set at a price level that reflects a reasonable profit target based on the trader’s risk-reward ratio and trading strategy.

Implementing proper position sizing

Position sizing refers to determining the number of units or contracts to trade based on the trader’s account size and risk tolerance. Proper position sizing is essential for managing risk and avoiding excessive losses.

Traders should consider the percentage of their trading capital they are willing to risk on each trade and adjust their position size accordingly. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

Using risk-reward ratio

The risk-reward ratio is a measure of the potential reward versus the potential risk of a trade. It compares the distance between the entry point and the stop loss level to the distance between the entry point and the take profit level.

Using a favorable risk-reward ratio helps ensure that the potential reward of a trade outweighs the potential risk. Day traders should aim for a risk-reward ratio of at least 1:2, meaning that the potential profit target is at least twice the size of the potential loss.

Implementing proper risk management strategies and sticking to them is crucial for day traders to protect their capital and achieve consistent profitability.

Developing a Trading Strategy

A well-defined trading strategy is the foundation of successful day trading. It provides a clear framework for identifying trading opportunities, entering and exiting trades, and managing risk.

Identifying trading opportunities

A trading strategy should include a set of rules and criteria for identifying potential trading opportunities. Traders can use a combination of fundamental analysis, technical analysis, or other indicators to identify setups that align with their trading strategy.

It is important to have a systematic approach to identify opportunities based on objective criteria rather than relying on emotions or impulsive decisions.

Entry and exit strategies

An effective trading strategy should include clear entry and exit strategies. Entry strategies define the criteria for entering a trade, such as specific price levels, chart patterns, or technical indicators. Exit strategies, on the other hand, define when to exit a trade, whether based on profit targets, stop loss levels, or other indicators.

By having well-defined entry and exit strategies, day traders can eliminate emotional decision-making and ensure consistency in their trading approach.

Backtesting and forward testing

Backtesting is the process of testing a trading strategy using historical data to assess its performance. It involves applying the strategy’s rules to past market data and evaluating the results.

Forward testing, also known as paper trading or demo trading, involves applying the trading strategy to live market conditions without risking real money. Traders can use demo accounts provided by brokers to practice and refine their strategies in a risk-free environment.

Both backtesting and forward testing are essential to evaluate the effectiveness of a trading strategy and make necessary adjustments before trading with real money.

Psychology of Day Trading

Successful day trading not only relies on technical and fundamental analysis but also on psychological factors. The following aspects of the psychology of day trading are crucial for long-term success.

Emotional control and discipline

Day trading can evoke strong emotions, such as fear, greed, and frustration. Emotional control is vital to avoid impulsive trading decisions and stick to the trading plan.

Maintaining discipline involves following the rules outlined in your trading plan and not deviating from your strategy due to emotions or external factors.

Managing stress and fear

Day trading can be highly stressful, especially during periods of high market volatility. Traders need to develop effective stress management techniques and strategies to prevent burnout and make rational trading decisions.

Fear can also have a significant impact on trading outcomes. Fear of missing out (FOMO) can lead to impulsive trades, while fear of losses can prevent traders from taking necessary risks. Developing techniques to manage fear and maintain a calm and rational mindset is crucial for day traders.

Building a winning mindset

Having a winning mindset is essential in day trading. It involves adopting a positive attitude, being resilient in the face of losses, and focusing on continuous learning and improvement.

Building a winning mindset also includes being patient, practicing self-reflection, and maintaining a long-term perspective. By approaching day trading with a positive mindset, traders can cultivate discipline, patience, and the ability to adapt to changing market conditions.

Common Mistakes to Avoid

Day trading can be challenging, and there are common mistakes that traders should avoid to improve their trading performance and profitability.

Overtrading and impulsive decisions

Overtrading is a common mistake among day traders. It involves taking too many trades in a short period, often driven by emotions or the desire to recover losses. Overtrading can lead to increased transaction costs, exhaustion, and poor decision-making.

Impulsive decisions, such as entering trades without proper analysis or overreacting to short-term price movements, can also lead to losses. It is important to stick to your trading plan, follow your strategy, and avoid impulsive trading decisions based on emotions or external factors.

Chasing losses and revenge trading

Chasing losses refers to the tendency to increase trading size or take excessive risks to recover losses from previous trades. This behavior can lead to further losses and impede rational decision-making.

Similarly, revenge trading involves trying to regain losses by taking revenge on the market. Revenge trading often leads to emotional decision-making and can result in even more significant losses.

It is important to accept losses as a natural part of trading and avoid making impulsive decisions to recover them. Stick to your risk management plan and avoid falling into the trap of chasing losses or seeking revenge.

Ignoring risk management

Neglecting risk management is a grave mistake in day trading. Without proper risk management strategies, traders are exposed to the potential for significant losses and account depletion.

Day traders should always set appropriate stop loss levels, implement proper position sizing, and use risk-reward ratios to ensure consistent and controlled trading outcomes. Ignoring risk management can lead to catastrophic results and hinder long-term profitability.

Choosing the Right Trading Tools

Selecting the right trading tools is essential for day traders to analyze the markets, execute trades, and monitor their performance.

Trading platforms and charting software

A reliable and user-friendly trading platform is crucial for day traders. Trading platforms provide real-time market data, order placement functionalities, and charting tools necessary for technical analysis.

When choosing a trading platform, consider factors such as accessibility, stability, customizability, and the availability of advanced features like backtesting and automation.

Useful forex trading indicators

Forex trading indicators help traders analyze price data and identify potential trading opportunities. There are numerous indicators available, ranging from simple moving averages to complex oscillators.

Choose indicators that align with your trading strategy and provide meaningful insights into price movements. Experiment with different indicators and find the ones that work best for your trading style.

Automated trading systems

Automated trading systems, also known as algorithmic trading or trading robots, can help day traders execute trades automatically based on predefined rules and criteria.

These systems use computer algorithms to analyze market data, identify trade setups, and execute trades without human intervention. Automated trading systems can help eliminate emotional decision-making, improve trade execution speed, and take advantage of market opportunities.

Consider the benefits and limitations of automated trading systems and determine if they align with your trading goals and preferences.

Monitoring and Evaluating Trades

Monitoring and evaluating trades is essential for day traders to learn from past trades, improve trading strategies, and make necessary adjustments.

Keeping a trading journal

A trading journal is a tool that allows traders to record and review their trades. It includes information such as entry and exit prices, trade size, rationale for entering the trade, and the outcome of the trade.

Keeping a trading journal helps traders identify patterns, strengths, and weaknesses in their trading strategies. It provides a historical record of trades that can be used for analysis, learning, and continuous improvement.

Reviewing and learning from past trades

Regularly reviewing past trades and reflecting on their outcomes is crucial for day traders. By analyzing past trades, traders can identify successful patterns, areas for improvement, and potential mistakes.

Reviewing past trades helps traders identify their strengths and weaknesses, refine their strategies, and make necessary adjustments to improve future trading outcomes.

Making necessary adjustments

After analyzing past trades and identifying areas for improvement, day traders should make necessary adjustments to their trading strategies. This could include modifying entry and exit criteria, adjusting risk management rules, or fine-tuning technical analysis tools.

Consistently monitoring and evaluating trades and making necessary adjustments is key to continuous improvement and long-term success in day trading.

In conclusion, day trading in forex involves buying and selling financial instruments within the same trading day to profit from short-term price movements. Day traders use a combination of fundamental and technical analysis to identify trading opportunities and manage risk effectively. By understanding the basics of day trading, setting up the right tools, developing a trading strategy, managing risk, and maintaining psychological discipline, traders can improve their chances of success in the dynamic world of day trading forex.