Are you interested in exploring the exciting world of forex trading? Look no further, as we have just what you need to get started! In this article, we will provide you with all the essential information and resources to embark on your forex trading journey. From understanding the basics of fx trading to the necessary tools and knowledge required, we have got you covered. So, grab a cup of coffee, sit back, and let’s dive into the world of forex trading together!

What Do I Need To Start Forex Trading

Forex trading, also known as foreign exchange trading, allows individuals to participate in the global currency market and profit from the fluctuations in currency prices. If you’re interested in getting started with forex trading, there are a few key things you’ll need to know and do. This comprehensive article will guide you through the steps of understanding foreign exchange, choosing a forex broker, creating a trading account, learning fundamental and technical analysis, developing a trading strategy, practicing on a demo account, managing risk, setting realistic goals, and maintaining discipline and emotions.

Understanding Foreign Exchange

Before diving into forex trading, it’s important to have a solid understanding of how the foreign exchange market works. The forex market is the largest financial market in the world, with trillions of dollars traded daily. It involves buying one currency and selling another simultaneously, with the aim of making a profit from the exchange rate fluctuations. Currencies are traded in pairs, such as EUR/USD or GBP/JPY, and the value of each currency is determined by various economic and geopolitical factors. It’s crucial to educate yourself on these factors and how they influence currency values before you start trading.

Choosing a Forex Broker

Selecting the right forex broker is a crucial step in your forex trading journey. A forex broker acts as the intermediary between you, the trader, and the forex market. They provide the trading platform, access to market liquidity, and various other services. When choosing a forex broker, you should consider factors such as regulatory compliance, trading platform features, customer support, account types, leverage options, and trading costs. Make sure to do thorough research and compare different brokers to find the one that aligns with your trading preferences and needs.

Creating a Trading Account

Once you have chosen a forex broker, the next step is to create a trading account. This involves providing the necessary personal information, going through the account verification process, and choosing the type of trading account that suits you best. There are typically different types of accounts available, such as standard accounts, mini accounts, or even demo accounts for practice purposes. Make sure to carefully read and understand the terms and conditions of the account before proceeding.

Learning Fundamental Analysis

Fundamental analysis plays a crucial role in forex trading as it involves analyzing various economic indicators, news events, and geopolitical factors to determine the intrinsic value of a currency. This type of analysis helps traders make informed decisions based on the overall health of an economy and its impact on currency values. To master fundamental analysis, you’ll need to stay up to date with economic news releases, central bank policies, and political developments that can influence currency prices. Economic calendars and news websites are great sources of information for fundamental analysis.

Mastering Technical Analysis

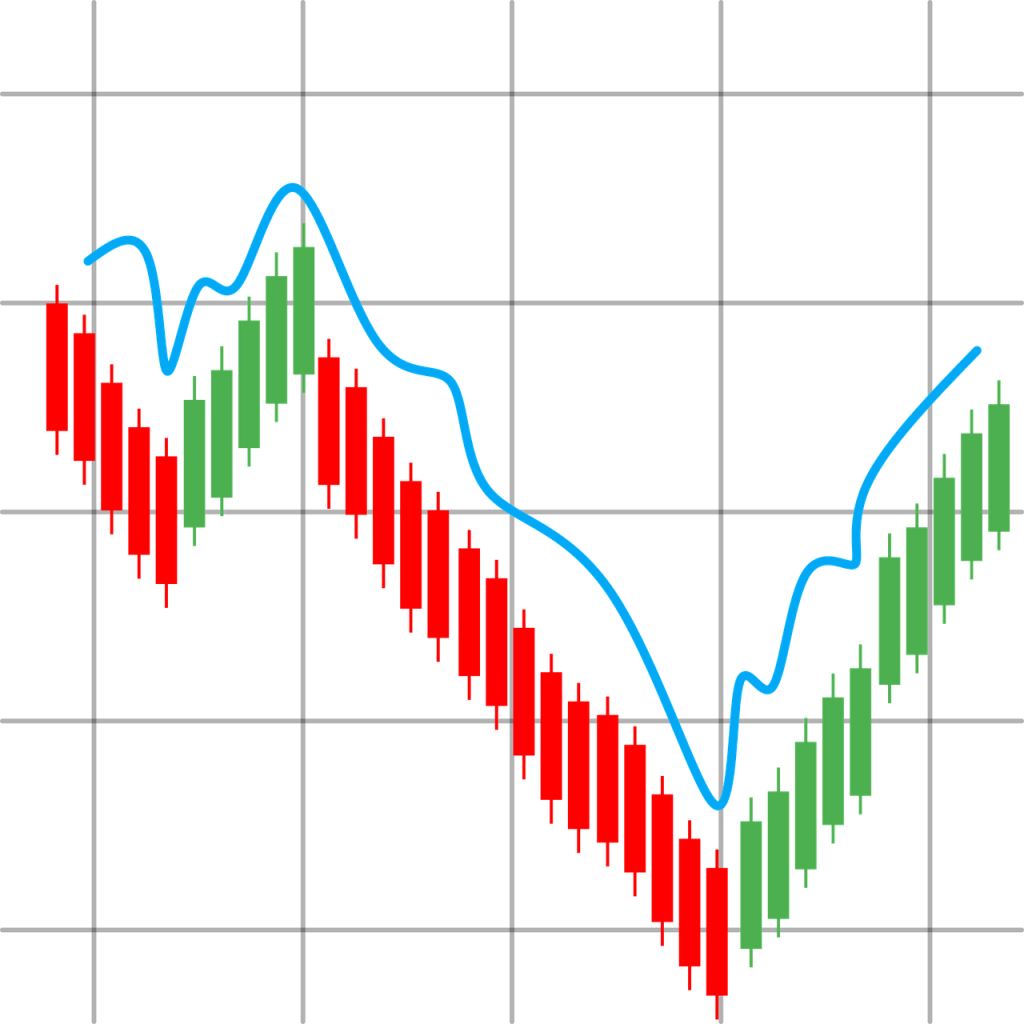

In addition to fundamental analysis, technical analysis is another essential skill for successful forex trading. Technical analysis involves studying historical price data and using various charting tools and indicators to identify patterns, trends, and potential entry or exit points in the market. It helps traders anticipate future price movements based on past market behavior. There are numerous technical analysis tools and indicators available, such as moving averages, trendlines, support and resistance levels, and Fibonacci retracements. Learning how to use these tools effectively and interpreting price charts will greatly enhance your trading skills.

Developing a Trading Strategy

Having a well-defined trading strategy is vital for consistent profitability in forex trading. A trading strategy is a set of rules and guidelines that outline when and how you will enter and exit trades. It helps you stay disciplined and avoid impulsive decisions based on emotions. Your trading strategy should consider factors such as timeframes, risk tolerance, profit targets, and stop-loss levels. It’s important to backtest your strategy using historical data and analyze its performance before implementing it in live trading. Remember that a trading strategy should be adaptable and flexible to changing market conditions.

Practicing on a Demo Account

Before risking real money in the forex market, it’s highly recommended to practice on a demo account. A demo account is a simulated trading environment that allows you to trade with virtual funds, mirroring real market conditions. It’s a valuable tool for beginner traders to test their strategies, practice executing trades, and familiarize themselves with the trading platform. Use the demo account to gain experience, refine your trading skills, and build confidence without any financial risk.

Managing Risk

Risk management is a crucial aspect of forex trading and should be a part of every trader’s strategy. It involves implementing measures to protect your trading capital and minimize potential losses. Some risk management techniques include setting stop-loss orders to limit losses, using proper position sizing to control exposure, diversifying your trades, and not risking more than a certain percentage of your trading capital per trade. Remember that no trading strategy can guarantee profits, so it’s essential to protect yourself against potential losses.

Setting Realistic Goals

Setting realistic goals is vital for maintaining a positive mindset and staying motivated in forex trading. It’s important to understand that forex trading is not a get-rich-quick scheme, and consistent profits require time, effort, and experience. Set achievable goals that align with your trading strategy and risk tolerance. Focus on the process of improving your trading skills and following your strategy rather than solely concentrating on the outcome of individual trades. Celebrate small achievements along the way to stay motivated and make steady progress towards your long-term goals.

Maintaining Discipline and Emotions

Maintaining discipline and managing emotions are critical factors in forex trading. The market can be volatile and unpredictable, and it’s easy to let fear or greed influence your decision-making process. Emotions can lead to impulsive trades and deviations from your trading strategy, which can result in losses. It’s important to stay disciplined, stick to your strategy, and not let emotions dictate your actions. Develop a trading routine, practice patience, and cultivate a positive mindset. Remember that losses are part of trading, and it’s important to learn from them and move forward.

By following these steps and continuously educating yourself, you will be well on your way to starting your forex trading journey. Remember that forex trading requires dedication, practice, and ongoing learning. Stay committed to your goals, manage risk effectively, and approach trading with a disciplined mindset. With time and experience, you’ll develop the necessary skills and strategies to navigate the forex market successfully. Good luck and happy trading!