In the ever-evolving world of finance, the Foreign Exchange Market holds a crucial position. This dynamic market, also known as forex trading or fx trading, deals with the buying and selling of different currencies from around the world. As individuals, businesses, and institutions engage in trading foreign exchange, they aim to capitalize on the constantly changing exchange rates to make profitable transactions. The Foreign Exchange Market plays a pivotal role in the global economy, impacting trade, investment, and even tourism. By understanding the intricacies of this market, you can navigate the world of international finance with confidence and potentially seize lucrative opportunities.

Definition of Foreign Exchange Market

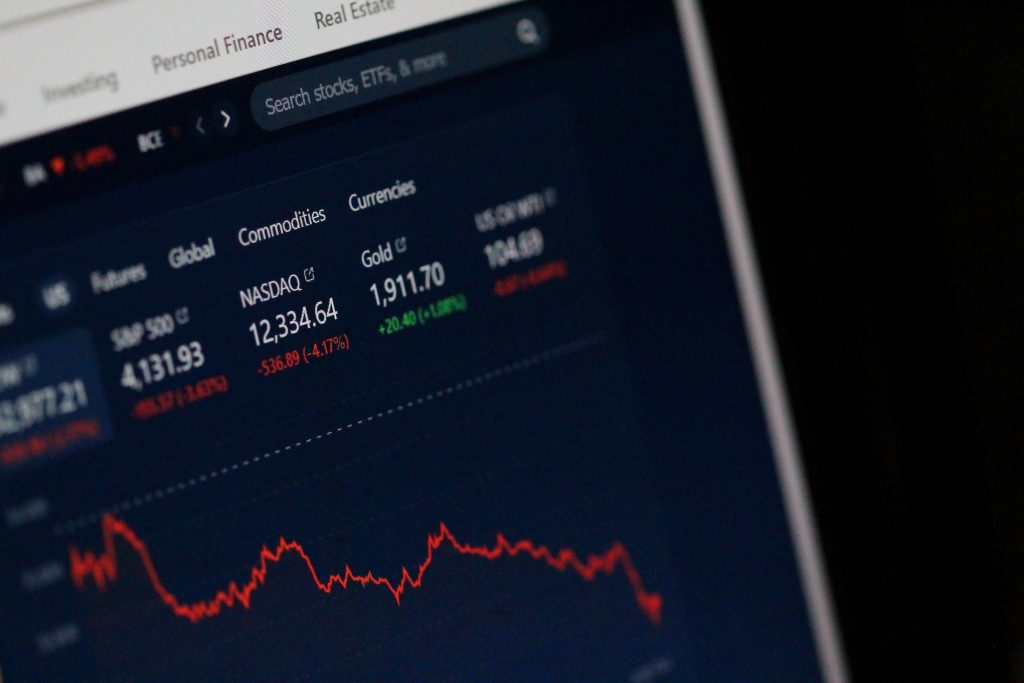

The Foreign Exchange Market, also known as the Forex market, is a decentralized global market where the trading of currencies takes place. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. The Forex market operates 24 hours a day, five days a week, allowing for continuous trading across different time zones. It is a crucial component of the global economy, as it facilitates international trade and investment by providing a platform for the exchange of currencies.

Overview of the Foreign Exchange Market

The Forex market allows individuals, businesses, financial institutions, and governments to exchange one currency for another. The exchange rate between two currencies is determined by various factors such as supply and demand, interest rates, economic indicators, and geopolitical events. Participants in the market can buy or sell currencies with the aim of making a profit from the fluctuation in exchange rates.

Participants in the Foreign Exchange Market

There are several key participants in the Foreign Exchange Market, each with different motivations and objectives. The main players include commercial banks, central banks, multinational corporations, hedge funds, retail traders, and government agencies. Commercial banks act as intermediaries, providing liquidity and facilitating currency transactions for their clients. Central banks play a vital role in setting monetary policy and managing foreign reserves. Multinational corporations engage in currency transactions for international trade and hedging purposes. Hedge funds and retail traders primarily engage in speculative trading to take advantage of exchange rate movements.

Types of Foreign Exchange Transactions

Foreign exchange transactions in the market can be categorized into spot transactions, forward transactions, futures contracts, and options contracts. Spot transactions involve the immediate exchange of currencies at the current market price. Forward transactions involve the exchange of currencies at a predetermined future date and rate. Futures contracts are standardized agreements to buy or sell currencies at a future date and price. Options contracts give the holder the right, but not the obligation, to buy or sell currencies at a predetermined price within a specified period.

Functions of the Foreign Exchange Market

The Foreign Exchange Market serves several essential functions that are crucial for global trade and investment.

Currency Conversion

One of the primary functions of the Forex market is to facilitate currency conversion. It allows businesses and individuals to exchange one currency for another to conduct international transactions. For example, if a company in the United States wants to import goods from Japan, it would need to convert U.S. dollars into Japanese yen to pay for the goods.

Hedging

Hedging is another vital function of the Foreign Exchange Market. It allows businesses and investors to protect themselves against potential currency risks. For example, a multinational corporation may hedge its foreign currency exposures by entering into forward contracts to lock in future exchange rates. By doing so, the company can reduce the uncertainty and potential losses caused by adverse exchange rate movements.

Speculation

Speculation is a significant driving force behind the trading activities in the Forex market. Traders and investors speculate on the direction of exchange rates with the aim of making a profit. They analyze various factors, such as economic indicators, geopolitical events, and technical analysis, to make informed trading decisions. Speculation adds liquidity to the market and can contribute to the efficiency of price discovery.

Arbitrage

Arbitrage refers to the practice of taking advantage of price discrepancies in different markets to make a risk-free profit. In the Foreign Exchange Market, traders may engage in arbitrage by exploiting differences in exchange rates between currency pairs or between spot and forward markets. Arbitrage activities help ensure that prices remain relatively consistent across different markets.

Structure of the Foreign Exchange Market

The Foreign Exchange Market is structured in different segments to cater to the diverse needs of market participants.

Spot Market

The spot market is the largest segment of the Forex market, where currencies are bought and sold for immediate delivery. Transactions in the spot market are settled “on the spot,” with the exchange of currencies occurring within two business days. The spot market is characterized by high liquidity and tight spreads, making it attractive to traders seeking short-term trading opportunities.

Forward Market

The forward market enables participants to enter into contracts for the exchange of currencies at a future date and a predetermined rate. These contracts, known as forward contracts, allow businesses to hedge their currency risk and plan for future international transactions. The forward market provides flexibility in terms of contract size, maturity, and currency pairs, catering to the specific needs of market participants.

Futures Market

The futures market is a regulated marketplace where standardized contracts for the buying and selling of currencies are traded. Unlike forward contracts, futures contracts are standardized and traded on exchanges. They have specific contract sizes, maturity dates, and settlement procedures. The futures market provides transparency and liquidity, allowing traders to speculate, hedge, or arbitrage on currency prices.

Options Market

The options market provides participants with the right, but not the obligation, to buy or sell currencies at a predetermined price within a specified period. Options contracts are traded on exchanges and come in different forms, such as call options and put options. The options market allows traders to hedge their positions or take advantage of potential price movements with limited risk.

Key Factors Influencing the Foreign Exchange Market

The Foreign Exchange Market is influenced by a wide range of factors that impact the supply and demand of currencies. Understanding these factors is essential for traders and investors to make informed decisions.

Economic Factors

Economic factors, such as GDP growth, inflation rates, interest rates, and employment data, play a significant role in shaping exchange rates. Strong economic fundamentals, such as high growth and low inflation, tend to attract capital inflows and strengthen a country’s currency. Conversely, weak economic data can lead to currency depreciation.

Political Factors

Political stability and geopolitical events can have a profound impact on the Foreign Exchange Market. Political uncertainty or instability can raise concerns among investors, leading to capital outflows and currency depreciation. Major political events, such as elections, referendums, and geopolitical tensions, can create volatility and uncertainty in the market.

Market Sentiment

Market sentiment refers to the overall mood and attitude of traders and investors towards a particular currency or market. It is influenced by factors such as economic data, political developments, and market perceptions. Positive market sentiment can result in currency appreciation, while negative sentiment can lead to depreciation.

Interest Rates

Interest rates set by central banks have a significant impact on currency values. Higher interest rates tend to attract foreign investments, increasing the demand for a country’s currency and leading to appreciation. Conversely, lower interest rates can discourage foreign investments and weaken a currency.

Major Currency Pairs in the Foreign Exchange Market

There are several major currency pairs that dominate the trading activities in the Forex market.

Euro (EUR) / United States Dollar (USD)

The EUR/USD currency pair is the most widely traded pair in the Forex market. It represents the exchange rate between the euro, the currency of the Eurozone, and the U.S. dollar, the reserve currency of the world. The EUR/USD pair is influenced by factors such as monetary policy decisions of the European Central Bank (ECB) and the U.S. Federal Reserve, economic data from both regions, and political developments.

Great British Pound (GBP) / United States Dollar (USD)

The GBP/USD currency pair, also known as the cable, represents the exchange rate between the British pound and the U.S. dollar. It is influenced by factors such as Brexit developments, Bank of England policy decisions, U.S. economic indicators, and market sentiment towards both currencies. The GBP/USD pair exhibits high volatility and is popular among traders looking for trading opportunities.

United States Dollar (USD) / Japanese Yen (JPY)

The USD/JPY currency pair represents the exchange rate between the U.S. dollar and the Japanese yen. It is influenced by factors such as the Bank of Japan’s monetary policy decisions, U.S. economic indicators, geopolitical events, and market sentiment towards both currencies. The USD/JPY pair is known for its sensitivity to changes in risk sentiment and is often used as a barometer of market risk appetite.

United States Dollar (USD) / Swiss Franc (CHF)

The USD/CHF currency pair represents the exchange rate between the U.S. dollar and the Swiss franc. It is influenced by factors such as Swiss National Bank policy decisions, U.S. economic data, geopolitical events, and market sentiment. The USD/CHF pair is known for its safe-haven status, as the Swiss franc is considered a refuge currency during times of market uncertainty.

The Role of Central Banks in the Foreign Exchange Market

Central banks play a crucial role in the functioning and stability of the Foreign Exchange Market.

Monetary Policy

Central banks use monetary policy tools, such as interest rate adjustments and quantitative easing, to maintain price stability and support economic growth. Changes in monetary policy can have a significant impact on exchange rates, as they influence interest rate differentials and market expectations.

Foreign Reserves Management

Central banks manage foreign reserves, which consist of foreign currencies and other assets, to maintain liquidity and stability in their domestic currency. They may intervene in the foreign exchange market by buying or selling currencies to influence the value of their own currency. This intervention can help stabilize exchange rates during periods of excessive volatility.

Intervention in the Currency Market

Central banks may intervene directly in the currency market to influence exchange rates. They can buy or sell their own currency to increase or decrease its value relative to other currencies. Intervention is typically used to address issues such as excessive volatility, currency overvaluation or undervaluation, and to maintain orderly market conditions.

Advantages and Disadvantages of Trading in the Foreign Exchange Market

Trading in the Foreign Exchange Market offers several advantages and disadvantages that traders should consider.

High Liquidity

The Forex market is highly liquid, meaning that there is a vast pool of buyers and sellers available at any given time. This high liquidity facilitates easy entry and exit from trades, allowing for quick execution and minimal slippage. It also provides traders with ample trading opportunities, including day trading and short-term scalping strategies.

24/5 Market Access

The Forex market operates 24 hours a day, five days a week, allowing traders to participate in trading activities at their convenience. This accessibility is particularly advantageous for traders in different time zones, as it ensures continuous market access and the ability to react to global news and events.

Leverage

The Forex market offers leverage, which allows traders to control larger positions with a smaller amount of capital. This leverage can amplify profits if trades are successful. However, it also increases the risk of losses, as losses are magnified in proportion to the leverage used. Traders should exercise caution and employ proper risk management strategies when trading with leverage.

Volatility

The Foreign Exchange Market is known for its volatility, which presents both opportunities and risks for traders. Volatility creates fluctuations in exchange rates, allowing traders to profit from price movements. However, it also increases the potential for losses, as prices can change rapidly and unpredictably.

Counterparty Risk

Trading in the Forex market involves counterparty risk, which arises from the possibility of default by a trading partner. Traders should choose reputable brokers and trading platforms that provide a high level of security and transparency. It is essential to conduct thorough research and due diligence to mitigate counterparty risk.

Steps to Start Trading in the Foreign Exchange Market

If you are interested in trading in the Foreign Exchange Market, here are the steps to get started:

Educate Yourself

Before diving into the Forex market, it is crucial to educate yourself about trading concepts, market analysis, risk management, and trading strategies. Take advantage of educational resources, such as online courses, books, webinars, and mentorship programs.

Choose a Reliable Broker

Selecting a reliable Forex broker is essential for a successful trading experience. Consider factors such as regulation, reputation, trading platforms, spreads, customer service, and available trading tools. Compare different broker options and choose one that suits your trading needs.

Open a Trading Account

Once you have chosen a broker, open a trading account. Provide the necessary documentation and complete the account opening process. Consider whether you want to open a demo account for practice or a live account to trade with real money.

Develop a Trading Strategy

Developing a trading strategy is crucial for consistent and profitable trading. Define your trading goals, risk tolerance, timeframes, and trading style. Create a robust trading plan that includes entry and exit criteria, risk management rules, and money management strategies.

Practice with Demo Accounts

Before trading with real money, practice your trading strategy on a demo account. Most brokers offer demo accounts with virtual funds, allowing you to simulate real trading conditions without risking your capital. Use this opportunity to refine your strategy and gain confidence in your trading abilities.

Start Trading with Real Money

Once you are comfortable with your trading skills and strategy, you can start trading with real money. Begin with a small amount and gradually increase your position size as you gain experience and profitability. Monitor your trades, analyze market conditions, and adapt your strategy accordingly.

Common Terms and Concepts in the Foreign Exchange Market

Here are some common terms and concepts that every Forex trader should be familiar with:

Bid and Ask Price

The bid price represents the price at which traders can sell a currency, while the ask price represents the price at which traders can buy a currency. The bid-ask spread is the difference between these two prices and is a cost that traders incur when entering a trade.

Spread

The spread refers to the difference between the bid and ask price of a currency pair. It represents the cost of trading and the profit margin for brokers. Tight spreads are preferable, as they reduce trading costs.

Pips

A pip, short for “point in percentage,” is the smallest unit of price movement in the Forex market. Most currency pairs are quoted to the fourth decimal place, with one pip representing a one-hundredth of a percent.

Margin

Margin is the amount of money required to open a position in the Forex market. It is a form of collateral that traders must deposit with their brokers to cover potential losses. Margin allows traders to control larger positions with a smaller amount of capital.

Leverage

Leverage allows traders to control larger positions in the market with a smaller initial investment. It is expressed as a ratio, such as 1:100, where a trader can control $100 in the market with $1 of capital. However, leverage magnifies both profits and losses.

Stop-Loss Order

A stop-loss order is a risk management tool used by traders to limit potential losses. It is an order placed with a broker to automatically close a trade when the price reaches a certain level, pre-determined by the trader.

Take-Profit Order

A take-profit order is an order placed with a broker to automatically close a trade when the price reaches a certain level, pre-determined by the trader. It allows traders to lock in profits and exit a trade at a predetermined target.

Risk Management in the Foreign Exchange Market

Effective risk management is crucial for long-term success in the Foreign Exchange Market. Here are some risk management techniques that traders should consider:

Setting a Risk-to-Reward Ratio

A risk-to-reward ratio is a measure of the potential profit compared to the potential loss of a trade. By setting a favorable risk-to-reward ratio, such as 1:2 or higher, traders ensure that their potential profits outweigh their potential losses. This helps maintain a positive overall expectancy in their trading strategy.

Using Stop-Loss Orders

Stop-loss orders are essential tools for managing risk in the Forex market. By setting stop-loss levels at appropriate points, traders can limit the potential losses of a trade. It is important to place stop-loss orders based on logical technical analysis levels, not arbitrary figures.

Diversification

Diversification involves spreading trading capital across different currency pairs or asset classes. By diversifying, traders can reduce the risk of being overly exposed to a single currency or market. Diversification should be done based on thorough analysis and understanding of each market.

Monitoring Market News and Events

Staying updated on market news and events is crucial for managing risk in the Forex market. Economic reports, central bank announcements, geopolitical developments, and other news can have a significant impact on exchange rates. Traders should stay informed to anticipate potential market movements and adjust their positions accordingly.

In conclusion, the Foreign Exchange Market plays a vital role in facilitating global trade and investment. It offers various opportunities for traders and investors to profit from currency fluctuations. Understanding the structure, functions, and key factors influencing the Forex market is essential for successful trading. By employing proper risk management techniques and staying updated on market developments, traders can navigate the complexities of the Forex market and strive for profitability.