If you’re interested in forex trading or trading foreign exchange, then the EURUSD Chart is something you need to know about. This chart provides invaluable insights into the fluctuations and trends of the EURUSD currency pair, allowing traders to make informed decisions. Whether you’re a seasoned trader or just starting out in the world of fx trading, the EURUSD Chart is a powerful tool that can help you navigate the dynamic world of forex trading.

What is EURUSD Chart?

Definition

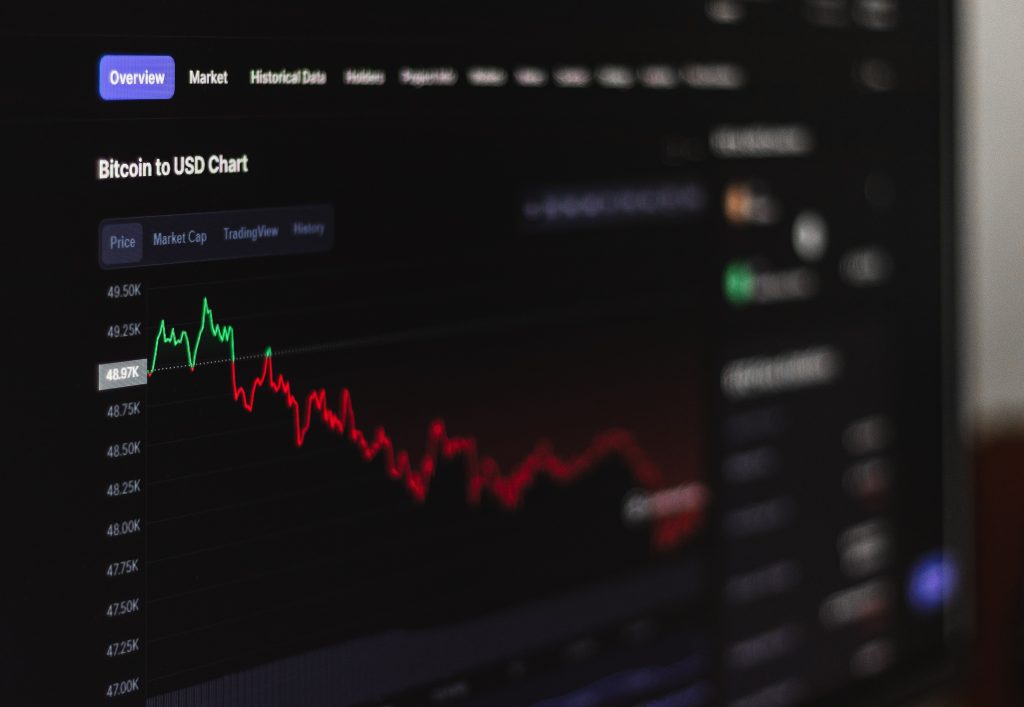

The EURUSD chart is a graphical representation of the exchange rate between the Euro (EUR) and the United States Dollar (USD). It shows the historical movement of the currency pair’s value over a specific time frame. Traders and analysts use the EURUSD chart as a tool to analyze and predict future market movements.

Importance

The EURUSD chart holds significant importance in the world of forex trading. As one of the most actively traded currency pairs, EURUSD is highly liquid and attracts traders from all around the globe. The chart provides valuable insights into the behavior of these two major currencies, helping traders make informed trading decisions.

Components

The EURUSD chart consists of several key components that are crucial for analysis. These include the price axis, which displays the exchange rate values, and the time axis, which represents the selected timeframe for analysis. Additionally, the chart includes various technical indicators, support and resistance levels, trends, and candlestick patterns, all of which play a vital role in understanding the market dynamics.

Analyzing the EURUSD Chart

Technical Indicators

Technical indicators are mathematical calculations applied to a price chart to identify potential entry and exit points for trades. In the case of the EURUSD chart, popular technical indicators such as moving averages, Fibonacci retracement, relative strength index (RSI), and Bollinger Bands can provide valuable insights into market trends, momentum, and overbought or oversold conditions.

Support and Resistance Levels

Support and resistance levels are key price levels on a chart where the buying or selling pressure tends to increase, causing the price to reverse or consolidate. Traders analyze these levels on the EURUSD chart to identify potential entry and exit points. Support levels act as a floor to prevent prices from falling further, while resistance levels act as a ceiling to prevent prices from rising further.

Trends

Trends play a crucial role in forex trading, as they indicate the general direction in which prices are moving over a specific period of time. By analyzing trends on the EURUSD chart, traders can gain insights into the market sentiment and adjust their trading strategies accordingly. Trends can be either upward (bullish), downward (bearish), or sideways (consolidation).

Candlestick Patterns

Candlestick patterns provide visual representations of price movements on the EURUSD chart. These patterns consist of individual candles that form various shapes and colors, indicating potential reversals, continuations, or indecision in the market. Traders use candlestick patterns to identify potential entry and exit points and to gauge market sentiment.

Factors Affecting EURUSD Chart

Economic Data

Economic data releases, such as gross domestic product (GDP), employment reports, inflation figures, and central bank announcements, have a significant impact on the EURUSD chart. Positive economic data for the Eurozone, for example, may strengthen the Euro against the US Dollar, causing the EURUSD chart to rise. Traders closely monitor economic indicators to anticipate potential currency movements.

Central Bank Policies

Monetary policies set by central banks, particularly the European Central Bank (ECB) and the Federal Reserve (Fed), have a profound impact on the EURUSD chart. Interest rate decisions, quantitative easing programs, and statements from central bank officials can significantly influence the exchange rate between the Euro and the US Dollar. Traders carefully analyze potential changes in central bank policies to adjust their trading strategies accordingly.

Geopolitical Events

Geopolitical events, such as elections, political unrest, trade wars, and natural disasters, can have a significant impact on the EURUSD chart. These events can cause sudden shifts in market sentiment, leading to increased volatility and potential currency fluctuations. Traders closely monitor geopolitical events around the world to assess their potential impact on the EURUSD pair.

Using EURUSD Chart for Trading

Formulating Trading Strategies

The EURUSD chart serves as a valuable tool for formulating trading strategies. Traders analyze the chart to identify patterns, trends, and potential market reversals. Based on their analysis, traders can develop trading strategies that take advantage of specific market conditions, such as trend-following strategies, range-bound strategies, or breakout strategies.

Identifying Entry and Exit Points

Traders use the EURUSD chart to identify optimal entry and exit points for their trades. By analyzing technical indicators, support and resistance levels, and candlestick patterns, traders can determine when to enter a trade to maximize potential profits and when to exit to limit potential losses. The EURUSD chart provides real-time data and price movements, allowing traders to make informed trading decisions.

Risk Management

Effective risk management is crucial when trading the EURUSD chart. Traders use risk management techniques such as setting stop-loss and take-profit levels, using trailing stops, and implementing position sizing strategies. By applying proper risk management techniques, traders can protect their capital and minimize potential losses in the forex market.

Common Mistakes in Analyzing EURUSD Chart

Overlooking Fundamental Analysis

While technical analysis plays a significant role in analyzing the EURUSD chart, it is essential not to overlook fundamental analysis. Fundamental factors, such as economic data, central bank policies, and geopolitical events, can have a profound impact on the currency pair’s value. Traders should consider both technical and fundamental analysis to gain a comprehensive understanding of the market.

Ignoring Market Sentiment

Market sentiment refers to the overall attitude and emotions of traders in the market. Ignoring market sentiment when analyzing the EURUSD chart can lead to incorrect trading decisions. Traders should pay attention to factors such as investor confidence, market trends, and news sentiment to gauge the prevailing sentiment and adjust their trading strategies accordingly.

Relying Exclusively on Indicators

While technical indicators provide valuable insights into the EURUSD chart, relying exclusively on indicators can be misleading. Overloading the chart with too many indicators or solely relying on their signals can result in contradictory or confusing analysis. Traders should use indicators as tools to support their overall analysis and not as the sole basis for trading decisions.

EURUSD Chart Analysis Tools

Moving Averages

Moving averages are widely used technical indicators on the EURUSD chart. They smooth out price fluctuations and provide traders with a visual representation of the average price over a specific period. Common types of moving averages include simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA). Traders use moving averages to identify trends, support and resistance levels, and potential entry and exit points.

Fibonacci Retracement

Fibonacci retracement is a popular tool for analyzing the EURUSD chart. It is based on the Fibonacci sequence, a mathematical sequence in which each number is the sum of the two preceding numbers (e.g., 1, 1, 2, 3, 5, 8, etc.). Traders use Fibonacci retracement levels to identify potential support and resistance levels, as well as areas of price retracement within a larger trend.

Relative Strength Index (RSI)

The relative strength index (RSI) is a momentum oscillator used on the EURUSD chart to measure the speed and change of price movements. It consists of a scale ranging from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions. Traders use the RSI to identify potential trend reversals and overbought or oversold levels.

Bollinger Bands

Bollinger Bands are another popular tool for analyzing the EURUSD chart. They consist of a moving average line in the center and two standard deviation lines above and below the moving average. Bollinger Bands expand during periods of high volatility and contract during periods of low volatility. Traders use Bollinger Bands to identify potential price breakouts, overbought or oversold conditions, and the volatility of the market.

Long-Term vs. Short-Term Analysis

Benefits and Limitations of Long-Term Analysis

Long-term analysis of the EURUSD chart provides traders with a broader perspective of market trends and potential future movements. By analyzing longer timeframes, such as daily, weekly, or monthly charts, traders can identify major trends and significant support and resistance levels. However, long-term analysis may require more patience, as it takes longer for trends to develop and validate trading strategies.

Benefits and Limitations of Short-Term Analysis

Short-term analysis of the EURUSD chart allows traders to focus on shorter timeframes, such as hourly or 15-minute charts, to capture quick price movements and take advantage of intraday trading opportunities. Short-term analysis provides more frequent trading opportunities and allows traders to react swiftly to new information. However, it may also result in increased transaction costs and may be more susceptible to market noise and false signals.

Using EURUSD Chart as a Forecasting Tool

Macroeconomic Analysis

The EURUSD chart can be used as a forecasting tool by incorporating macroeconomic analysis. Traders analyze economic indicators, such as GDP growth, inflation rates, and employment figures, to anticipate potential currency movements. By combining macroeconomic analysis with the EURUSD chart, traders can gain insights into the underlying factors driving the currency pair’s value and make more accurate forecasts.

Correlations with Other Currency Pairs

The EURUSD chart can also be used to forecast the movement of other currency pairs. By analyzing the historical correlation between the EURUSD chart and other currency pairs, traders can identify potential relationships and make predictions based on those correlations. For example, if the EURUSD chart shows a bullish trend, it may indicate a potential bullish move in other Euro-related currency pairs.

EURUSD Chart and Market News

Keeping Up with Market Updates

Staying informed about market news and events is essential when analyzing the EURUSD chart. Traders need to keep abreast of economic data releases, central bank announcements, geopolitical events, and other news that can impact the currency pair’s value. By staying updated, traders can adjust their analysis and trading strategies accordingly.

Impact of News on the Chart

News has a significant impact on the EURUSD chart, often causing sudden price movements and increased volatility. Positive news for the Eurozone, such as better-than-expected economic data or optimistic statements from central bank officials, can lead to a rise in the EURUSD chart. Conversely, negative news can cause the chart to decline. Traders need to be aware of the potential impact of news events on the chart to effectively manage their trades.

EURUSD Chart and Risk Management

Setting Stop-Loss and Take-Profit Levels

Setting appropriate stop-loss and take-profit levels is essential in managing risk when trading the EURUSD chart. Traders use stop-loss orders to limit potential losses if the trade goes against them, while take-profit orders help capture profits if the trade moves in their favor. By carefully placing these levels based on technical analysis and risk tolerance, traders can protect their capital and optimize their risk-reward ratio.

Using Trailing Stops

Trailing stops are a useful tool for managing risk on the EURUSD chart. A trailing stop order automatically adjusts the stop-loss level as the trade moves in the trader’s favor, thereby locking in profits and minimizing potential losses. Trailing stops provide traders with a flexible approach to risk management, allowing them to capitalize on favorable price movements while protecting their gains.

Position Sizing

Proper position sizing is crucial when trading the EURUSD chart. Traders determine the optimal position size based on their risk tolerance, account size, and trading strategy. By carefully calculating the position size, traders can control their risk exposure and prevent significant losses in case of adverse price movements. Position sizing ensures that traders allocate an appropriate percentage of their capital to each trade, based on their risk management plan.

In conclusion, the EURUSD chart is a valuable tool for forex traders to analyze and predict future market movements. By understanding the components, analyzing technical indicators and support and resistance levels, considering various factors affecting the chart, and utilizing risk management strategies, traders can effectively use the EURUSD chart to make informed trading decisions. However, it is essential to avoid common mistakes, such as overlooking fundamental analysis and relying exclusively on indicators, while also considering both long-term and short-term analysis. By incorporating the EURUSD chart as a forecasting tool, staying updated with market news, and implementing proper risk management techniques, traders can enhance their trading strategies and maximize their chances of success in the forex market.