If you’re looking to venture into the world of forex trading or enhance your current trading strategies, it’s vital to have the right broker by your side. In this article, we’ll take a closer look at some of the best brokers of forex. Whether you’re new to trading or a seasoned investor, these reputable brokers offer a range of features and services that can help you navigate the dynamic world of forex with ease. From user-friendly platforms to competitive prices and extensive market research tools, these brokers are dedicated to providing a seamless trading experience for traders of all levels. Stay tuned to discover the brokers that can elevate your forex trading journey to new heights.

Regulation

Regulation plays a crucial role in the forex trading industry. It ensures that brokers operate in a fair and transparent manner, providing traders with a level of security and confidence. The importance of regulation cannot be emphasized enough, as it protects traders from fraudulent activities and ensures that their funds are secure.

Regulatory bodies exist to oversee the operations of forex brokers and enforce compliance with industry standards. These regulatory bodies vary from country to country, but some of the most prestigious and well-respected ones include the Financial Conduct Authority (FCA) in the United Kingdom, the Commodity Futures Trading Commission (CFTC) in the United States, and the Australian Securities and Investments Commission (ASIC) in Australia.

Each country has its own set of regulations and requirements for forex brokers. It is important to consider the regulatory environment of a broker before opening an account. Some countries have stricter regulations than others, which may provide additional protection for traders. It is also advisable to check whether a broker is licensed and registered with the appropriate regulatory body.

There are certain signs that indicate whether a broker is regulated or not. One of the first things to look for is the broker’s license number, which should be prominently displayed on their website. Regulated brokers are also required to keep client funds separate from their own operational funds, which ensures that traders’ funds are protected even in the event of the broker’s bankruptcy. Additionally, regulated brokers are subject to regular audits and financial reporting, providing further assurance of their financial stability and transparency.

Trading Platforms

Choosing the right trading platform is crucial for successful forex trading. There are several popular trading platforms available in the market, each with its own set of features and benefits. Some of the most widely used forex trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

When selecting a trading platform, it is important to consider factors such as ease of use, reliability, and the availability of advanced features. MT4 is known for its user-friendly interface, extensive charting capabilities, and a wide range of technical indicators and expert advisors. MT5, on the other hand, offers additional features such as more advanced order types and a built-in economic calendar.

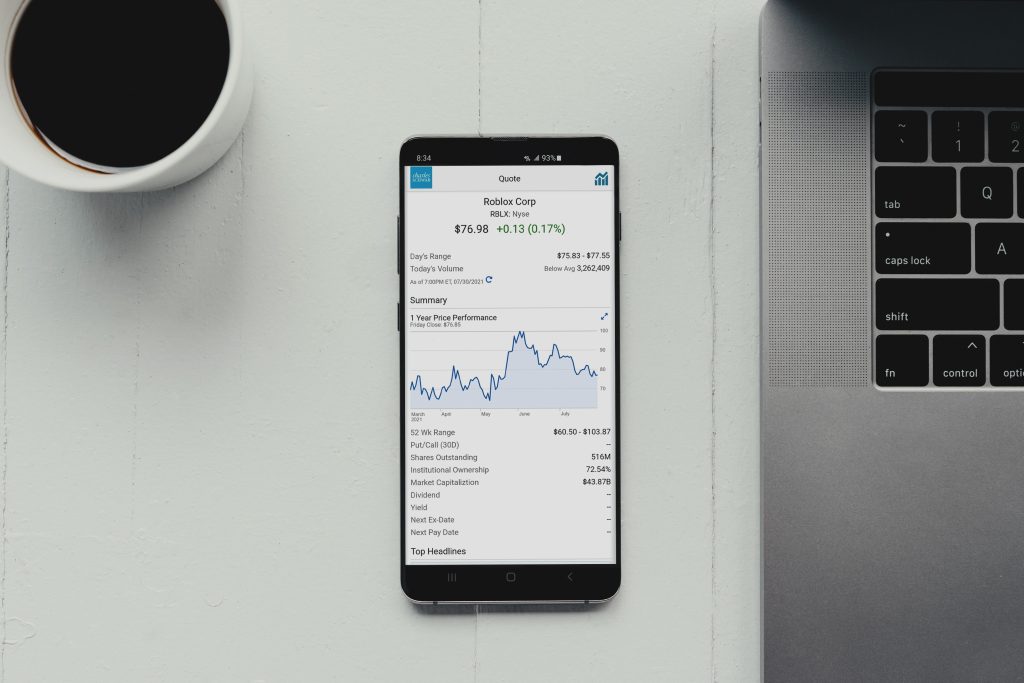

In recent years, mobile trading apps have gained popularity among traders. These apps allow traders to access their trading accounts and execute trades on the go, providing flexibility and convenience. When evaluating mobile trading apps, it is important to consider factors such as speed, functionality, and compatibility with different devices.

Demo accounts are another important feature to consider when choosing a trading platform. These accounts allow traders to practice their trading strategies and familiarize themselves with the platform’s features without risking real money. Demo accounts are an excellent tool for both beginner and experienced traders, as they allow for experimentation and the development of skills without any financial consequences.

Account Types

Forex brokers typically offer different types of trading accounts to cater to the needs of different traders. The most common types of accounts include standard accounts, mini accounts, micro accounts, and Islamic accounts.

Standard accounts are suitable for experienced traders who want to trade larger volumes. These accounts usually require a higher minimum deposit and offer lower spreads compared to other account types. With a standard account, traders can access a wide range of trading instruments and take advantage of various trading strategies.

Mini accounts are designed for traders who are just starting their forex trading journey. These accounts typically require a lower minimum deposit and offer smaller position sizes. Mini accounts provide an opportunity for beginners to learn and practice trading with real money, albeit with lower risk exposure.

Micro accounts are similar to mini accounts but with even smaller position sizes. They are ideal for traders with very limited trading capital or those who want to trade with lower risk. Micro accounts allow for gradual capital growth and provide the opportunity to gain experience in live trading without risking significant amounts of money.

Islamic accounts, also known as swap-free accounts, are designed to cater to the needs of Muslim traders who follow Shariah law. These accounts operate in compliance with Islamic principles that prohibit the charging or paying of interest. Islamic accounts are interest-free and do not involve rolling over positions overnight, making them suitable for traders who want to trade in accordance with their religious beliefs.

Trading Instruments

Forex trading offers a wide range of trading instruments for traders to choose from. The primary trading instrument in forex is currency pairs, which involve the simultaneous buying of one currency and selling of another. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, are the most commonly traded and offer high liquidity and tight spreads.

In addition to currency pairs, forex brokers also offer trading in other instruments such as commodities, stocks, and indices.

Commodities such as gold and oil are popular choices among forex traders. Trading commodities allows traders to diversify their portfolios and take advantage of price movements in these markets. Commodities are often influenced by geopolitical events and economic factors, offering trading opportunities for those who can analyze and interpret these factors effectively.

Stocks of major companies are also available for trading in the forex market. Trading stocks allows traders to speculate on the price movements of individual companies, taking advantage of both rising and falling markets. Stocks are influenced by factors such as corporate earnings, market sentiment, and company-specific news, providing ample trading opportunities.

Indices represent a basket of stocks from a particular market or sector. Trading indices allows traders to gain exposure to the broader market and take advantage of overall market trends. Indices are influenced by a wide range of factors, including economic indicators, political events, and market sentiment.

Leverage and Margin

Leverage is one of the key features of forex trading that allows traders to trade larger positions with a smaller amount of capital. It is a double-edged sword that amplifies both profits and losses, making it important for traders to understand how leverage works and its implications.

Leverage is expressed as a ratio, such as 1:100 or 1:500, indicating the amount of capital required to open a position. For example, with a leverage ratio of 1:100, a trader can control a position worth $100,000 with a capital of $1,000. Leverage allows traders to magnify their potential profits, but it also increases the risk of losses.

The maximum leverage offered by brokers varies and is subject to regulatory restrictions. Higher leverage ratios offer the potential for greater profits, but they also increase the risk of significant losses. It is important for traders to choose a leverage ratio that aligns with their risk tolerance and trading strategy.

Margin is the amount of money required to open and maintain positions in the forex market. It is a form of collateral that traders need to provide to cover potential losses. Margin requirements vary among brokers and are usually expressed as a percentage. For example, if a broker requires a margin of 2%, a trader needs to have 2% of the total trade value in their trading account.

The effect of leverage on trading is significant. While it can amplify profits, it can also lead to substantial losses. Traders should always exercise caution when using leverage and have a clear risk management strategy in place to protect their capital.

Spreads and Fees

When trading forex, traders encounter two types of spreads: fixed spreads and variable spreads. Fixed spreads remain constant regardless of market conditions, while variable spreads fluctuate depending on market liquidity and volatility. Fixed spreads provide more predictability in trading costs, while variable spreads reflect market conditions more accurately.

When evaluating brokers, it is important to consider the spreads they offer. Lower spreads result in lower trading costs for traders, making it easier to generate profits. Spreads can vary significantly between brokers, so it is advisable to compare spreads across different brokers to find the most competitive option.

In addition to spreads, brokers may charge additional fees and commissions. These fees can include deposit and withdrawal fees, inactivity fees, and fees for certain trading features. It is important for traders to be aware of these additional costs when choosing a broker.

Calculating trading costs is an essential aspect of forex trading. By considering the spread, fees, and potential slippage, traders can determine the total cost of executing trades and plan their strategies accordingly. It is advisable to keep trading costs as low as possible to improve profitability.

Customer Support

Having access to reliable customer support is important for forex traders, especially for those who are new to the industry. A broker with excellent customer support can provide assistance and resolve any issues or concerns that traders may have.

24/7 support is a desirable feature as forex trading operates around the clock, five days a week. Having access to customer support at any time ensures that traders can receive assistance whenever they need it, regardless of their location and time zone.

Live chat support is particularly convenient for traders, as it allows for real-time interactions with customer support representatives. This feature enables quick responses and efficient problem-solving, ensuring that traders can proceed with their trading activities without unnecessary delays.

Email and phone support are also important channels for customer support. These methods provide a more personalized approach, allowing traders to have their questions or concerns addressed in detail. Email support is especially useful for complex inquiries that may require additional documentation or explanations.

Educational resources are another aspect of customer support that traders should consider when choosing a broker. Brokers that offer educational materials such as tutorials, webinars, and trading guides can provide valuable knowledge and insights to help traders improve their skills and make more informed trading decisions.

Deposit and Withdrawal Methods

The ease and convenience of depositing and withdrawing funds from a trading account are important considerations for forex traders. Brokers typically offer a variety of payment methods to cater to the needs of different traders.

Accepted payment methods vary among brokers but commonly include bank transfers, credit/debit cards, and online payment systems such as PayPal, Skrill, and Neteller. It is important to consider the availability and suitability of payment methods for your specific needs when selecting a broker.

Processing time for deposits and withdrawals can vary depending on the payment method and the broker’s policies. While some methods offer quick processing times, others may take longer. It is advisable to choose a broker that offers fast and efficient processing to ensure timely access to funds.

Withdrawal fees are another factor to consider when selecting a broker. Some brokers may charge fees for withdrawal transactions, especially for certain payment methods or when withdrawing smaller amounts. It is important to carefully review a broker’s withdrawal fee structure to avoid unexpected costs.

Security of transactions is a critical aspect of depositing and withdrawing funds. Trusted brokers employ advanced encryption technology to ensure the security and confidentiality of financial transactions. It is essential to choose a broker with robust security measures in place to protect your personal and financial information.

Education and Research

Continuous education and access to market analysis tools are vital for forex traders to stay informed and make well-informed trading decisions. Brokers that offer comprehensive educational resources and research tools can significantly enhance traders’ trading experience.

Forex education materials such as tutorials, e-books, and video courses can help traders understand the fundamentals of forex trading and develop their trading skills. These resources cover a wide range of topics, including technical analysis, fundamental analysis, risk management, and trading psychology. By investing time in learning, traders can improve their trading performance and increase their chances of success.

Market analysis tools are essential for traders to stay updated on market trends and make informed trading decisions. These tools can include real-time market news, economic calendars, and technical analysis indicators. Brokers that provide access to these tools empower traders to make informed predictions and identify potential trading opportunities.

Trading signals are another valuable feature offered by some brokers. Trading signals are indicators or algorithms that identify potential trade setups and provide entry and exit points. They can save traders time and effort by providing trading ideas that can be used as a basis for their own analysis.

Webinars and workshops conducted by experienced traders or market experts can provide valuable insights and trading strategies. These events allow traders to interact, ask questions, and learn from professionals in the field. Webinars and workshops are excellent platforms for networking and gaining knowledge that can further enhance trading skills.

Account Security

Account security is a top priority for forex traders. Trusted brokers implement various security measures to protect traders’ personal and financial information, ensuring a secure trading environment.

Encryption and data protection are key security features that ensure the confidentiality and integrity of traders’ data. Brokers use advanced encryption technology to secure data transmissions between their servers and traders’ devices. This technology prevents unauthorized access and protects against potential cyber threats.

Two-factor authentication (2FA) is an additional layer of security that brokers may offer. With 2FA, traders need to provide a second piece of information, such as a unique code generated through an authentication app, in addition to their username and password. This extra step adds an additional level of protection against unauthorized access to trading accounts.

Secure financial transactions are crucial to protect traders’ funds. Trusted brokers use secure payment gateways and follow strict financial regulations to ensure the safety of deposit and withdrawal transactions. By partnering with reputable payment service providers, brokers provide assurance that financial transactions are conducted securely and efficiently.

Cybersecurity measures are essential to safeguard against potential cyber threats and attacks. Brokers invest in robust IT infrastructure and employ cybersecurity experts to ensure the integrity of their systems and protect traders’ accounts from hacking attempts and unauthorized access.

In conclusion, the forex trading industry offers a wide range of opportunities for traders, but it is essential to consider various factors when choosing a broker. Regulation, trading platforms, account types, trading instruments, leverage and margin, spreads and fees, customer support, deposit and withdrawal methods, education and research, as well as account security are all crucial aspects to evaluate. By taking the time to research and choose a reputable and reliable broker, traders can enhance their trading experience and increase their chances of success.